March 18th Transform Westside Summit: Westside Future Fund’s Home on the Westside Update

Westside Future Fund’s March 18th Transform Westside Summit highlighted the positive impacts that the Home On the Westside program is having towards creating housing equity for legacy residents on Atlanta’s Historic Westside. Featured guests included WFF personnel: Rachel Carey, Chief Real Estate Officer; Derrick Jordan, Real Estate Contractor; Tameka Askew, Manager, Home on the Westside; and Raquel Hudson, Director of Programs, Home On the Westside. WFF President & CEO, John Ahmann joined co-hosts Ebony Ford and Benjamin Earley in opening the show while once again welcoming in-person attendees. After which, Ford and Earley went on to moderate the panel discussion.

(from left) John Ahmann, WFF President & CEO; and co-hosts Ebony Ford and Benjamin Earley welcome attendees.

With all the panelists seated and introduced, Ebony Ford asked Raquel Hudson, Director of Programs, the first question of the day.

Ford: “Tell us a little bit more about the Home on the Westside program and how the need arose for this type of assistance?”

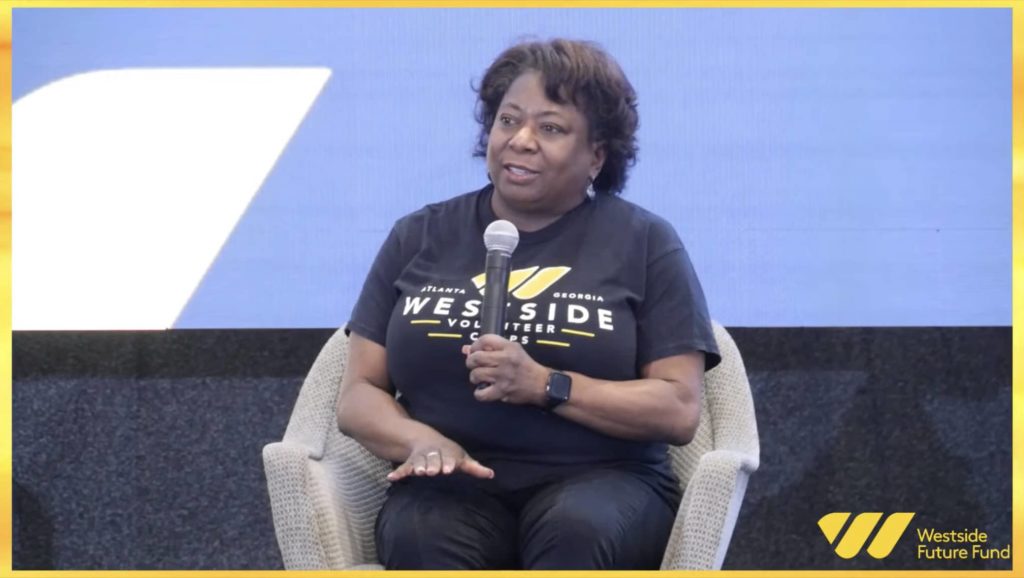

Raquel Hudson gives an overview of Home on the Westside.

Hudson: “So it is a signature program for the organization and it is our way of being able to really execute and implement our commitment to community retention. So there are three parts to Home on the Westside, and that is our pathway to rental opportunities, our pathway to homeownership, as well as the Anti-Displacement Tax Fund.”

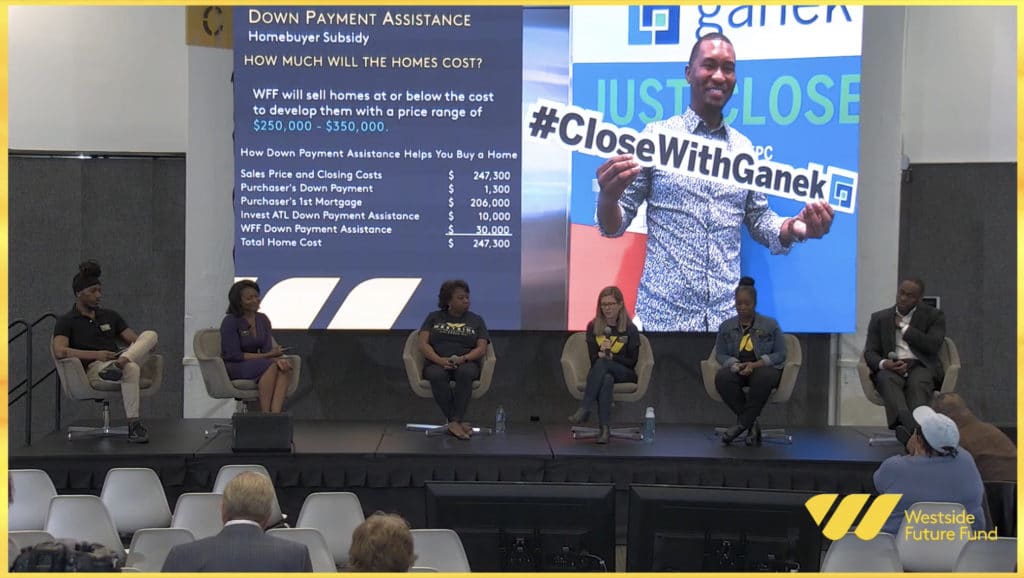

WFF panelists share recent success stories while outlining the process of becoming a homeowner through HOTW.

Hudson: “We want to make sure that as this neighborhood revitalizes that it is done in such a way that it is equitable, and so that we are able to create a mixed income community…and those people who have been a part of the community for a long time are able to stay…We want them to be able to stay, and be able to afford [to be] a part of the transition and take advantage of that rising tide.”

Ebony Ford shares how the ADTF has helped assure that she can remain a Westside resident for the foreseeable future.

Ford: “I entered the program in 2017, and the increase in my taxes will be paid for 20 years. That is until 2037—like oh my gosh, such a blessing. And my taxes, to get a little bit personal, were $27.02 in 2017, and that was county and city. My taxes now are about $1,800 a year. I said before on one of the summits, it’s all well and good to have a fixed rate mortgage, but if your taxes are continuing to climb, what good is the fixed rate mortgage, right? You could still lose your house. So I’m very, very grateful. I’m an actual recipient here.”

Benjamin Earley and Ebony Ford co-moderate at the Transform Westside Summit.

Earley: “Question for Rachel, we know that Westside Future Fund services a lot of people who are in need of rental units. So can you just talk about what the rental units program is?”

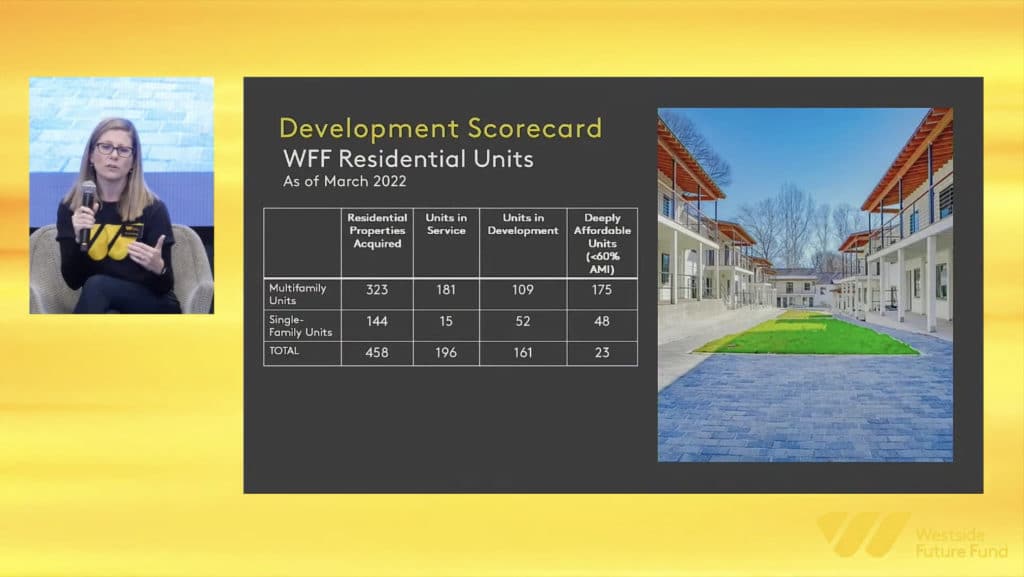

Rachel Carey talks recent HOTW developments and future goals.

Carey: “So back in 2017, when we started thinking through the mixed income communities, we did some work to survey the number of housing units in the neighborhood and the incomes of the people living in those housing units. And what we identified was just about 1,500 renters in multifamily units, who were at risk of displacement because of rising rents and because of lack of quality housing. Those were the folks in the lowest income tiers. And so we kind of set a goal for the neighborhood, that as there’s development happening as there’s repopulation of the neighborhoods, there still needs to be this bedrock of about 1,500 deeply affordable high-quality multifamily units…And so we thought Atlanta Housing, Quest, and others would take care of about 700 of those units or so. But the Westside Future Fund, we would commit to taking on 800 of those units—pretty ambitious goal.”

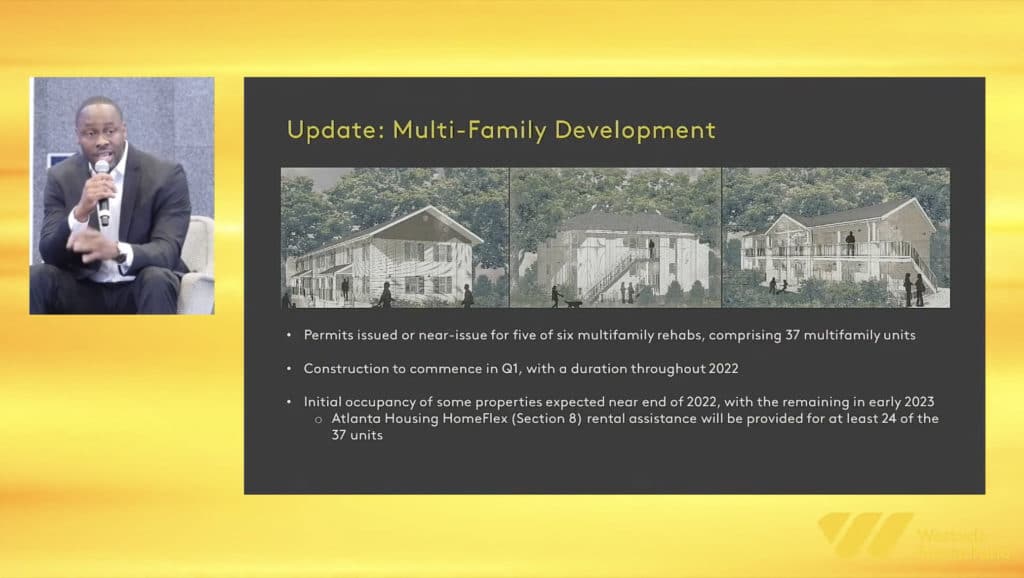

Derrick Jordan gives updates on HOTW multifamily property rehabs.

Jordan: “We have about 36 total apartment units that we will be developing over the next six to twelve months, all in the English Avenue community. And what’s important about these types of developments…is the fact that they are going to be affordable to the lowest of the low income. We’re going to have PPRA that’s going to be attached to these projects from Atlanta Housing Authority. Working with partnerships like Invest Atlanta, we’ve been able to come in and acquire, and are now going to be spending a total of around $6 million to rehab these units.”

“But what we also add is value to the community when we are removing eyesores that have been from dilapidation and graffiti. We’re going to come in with high-quality units. We’re going to make sure that these units are accessible because many of these units were built in the 1950s. So they weren’t thinking about those type of things back then…So you’re going to see new development in your community. You’re going to see the creation of local jobs…because of developments like this.”

Having visited many of the properties currently in operation, Earley paused to commend Westside Future Fund’s commitment to making high quality the norm in affordable housing:

Unfortunately when we talk about affordable housing, what we’re used to and what people who are living in quote, affordable housing, have been forced to get used to is dilapidated housing,” said Earley. “People should be able to have dignity in where they live…regardless of how much they can afford to pay…Thank you all for the work that you’re doing because it really does go a long way…”

Adding to the discussion, Tameka Askew spoke on the logistics behind getting residents ready for home buying.

Tameka Askew paints a detailed picture of the process of becoming a homeowner through HOTW.

Tameka Askew: “One of the big things that I’m excited about is we partner with On the Rise Financial Center. So once you are verified and you’re sent to On the Rise and you set up an appointment with a financial coach, that financial coach works with you one on one—your credit score, giving you the mortgage rate, and is just step by step on what it takes to actually be in a home and actually stay excellent in budgeting. And I can say for myself, because I came from On the Rise as a financial coach, one of the biggest things is we can have people that are actually coming through the pipeline and you have all the credentials, but we have to actually be realistic with people and say, ‘What is your debt to income ratio?’”

“So they’ll work with you on that budget, getting your credit score where it needs to be, [and] learning how to really create a realistic budget that works for you so you can be ready for homeownership.”

View the full summit including the audience Q&A below!